By Darasimi kikelomo

Abuja, April 29, 2025 —Nigeria’s economy is beginning to show signs of stability and renewed investor interest, thanks to sweeping financial sector reforms initiated by the Central Bank of Nigeria (CBN) under Governor Olayemi Cardoso.

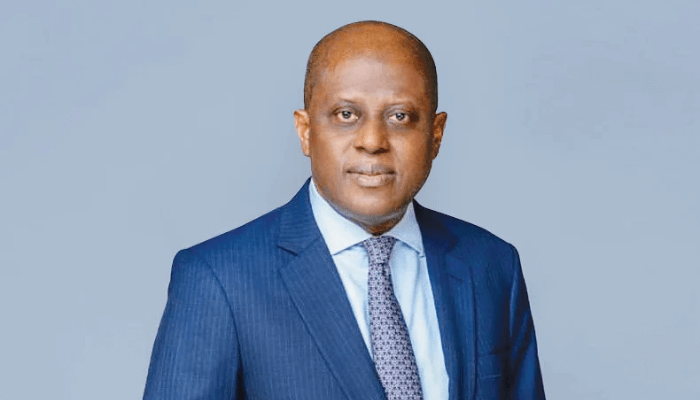

Speaking during a policy briefing in Abuja, Cardoso said the reforms—although difficult—are proving effective in stabilizing key macroeconomic indicators, boosting foreign capital inflows, and rebuilding confidence in the Nigerian economy.

“The road has been tough, but the gains are real,” Cardoso remarked. “We’ve seen exchange rate stabilization, increased investor participation, improved economic buffers, and encouraging signs of inflation moderation. These are early but significant victories for our reform efforts.”

Since assuming office in October 2023, Cardoso has led a reform agenda centered on monetary discipline, curbing inflation, and restoring the independence and credibility of the central bank. One of the early targets was the rapid growth in money supply, which had fueled inflation and contributed to the naira’s depreciation.

The CBN adopted more orthodox monetary tools, raising interest rates, reducing excess liquidity, and guiding the exchange rate towards market-determined levels. These efforts, according to Cardoso, are beginning to ease inflationary pressures and anchor investor expectations.

“Our approach has been deliberate—tightening where necessary, staying transparent, and sending clear signals to the market,” he said. “We’re seeing the benefits in stronger capital flows and improved market sentiment.”

Nigeria, like many economies around the world, has been contending with external shocks in recent years—from the lingering effects of the COVID-19 pandemic to geopolitical tensions that disrupted global food and energy supplies. These challenges were compounded by internal imbalances, including high inflation and low GDP growth.

Cardoso stressed the importance of building economic buffers that can shield the country from such shocks. He identified fiscal discipline, inflation targeting, and economic diversification as key pillars for long-term stability.

“Inflation acts like a silent tax, eroding the purchasing power of everyday Nigerians,” Cardoso explained. “It creates uncertainty for businesses and discourages investment. Tackling it is not just a policy goal—it’s a national imperative.”

With the central bank’s reforms taking root, many observers are optimistic about Nigeria’s prospects for stronger economic performance. While challenges remain, the early signs suggest that the CBN’s strategic pivot is setting the country on a more sustainable path.

“We are not declaring victory yet,” Cardoso cautioned. “But we are confident that the foundation we are laying today will support a more resilient and inclusive economy tomorrow.”